State Tax Comparison

- Get link

- X

- Other Apps

For a visual comparison of state income taxes across the United States see our state income tax map. Facts and Figures a resource weve provided to US.

Us Property Tax Comparison By State Armstrong Economics

Us Property Tax Comparison By State Armstrong Economics

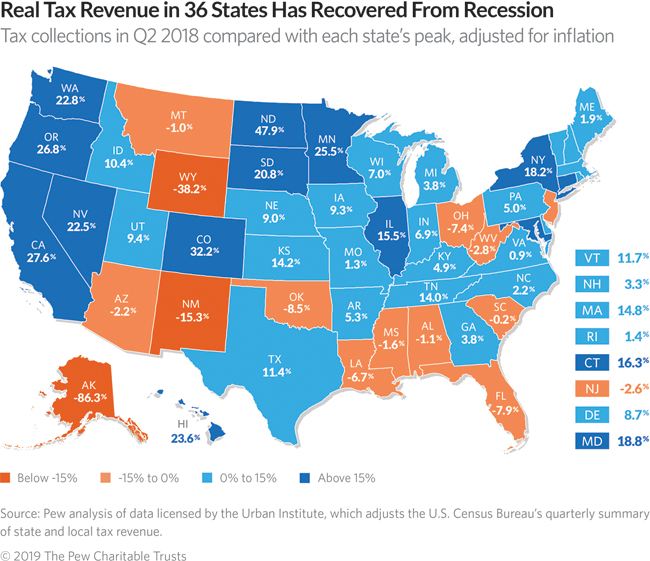

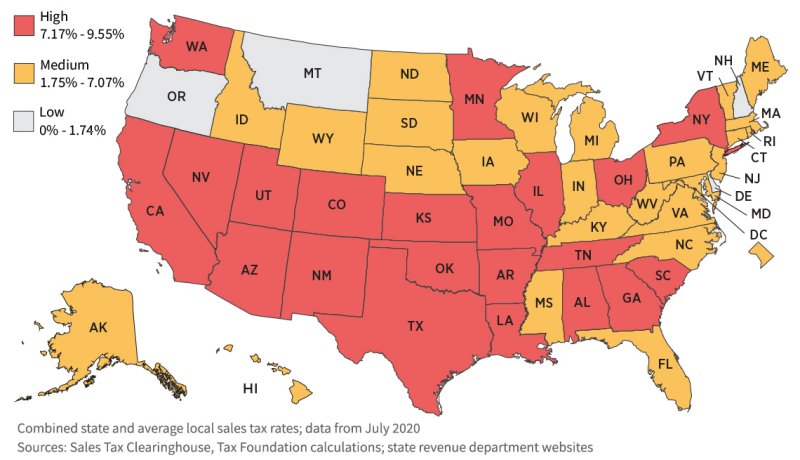

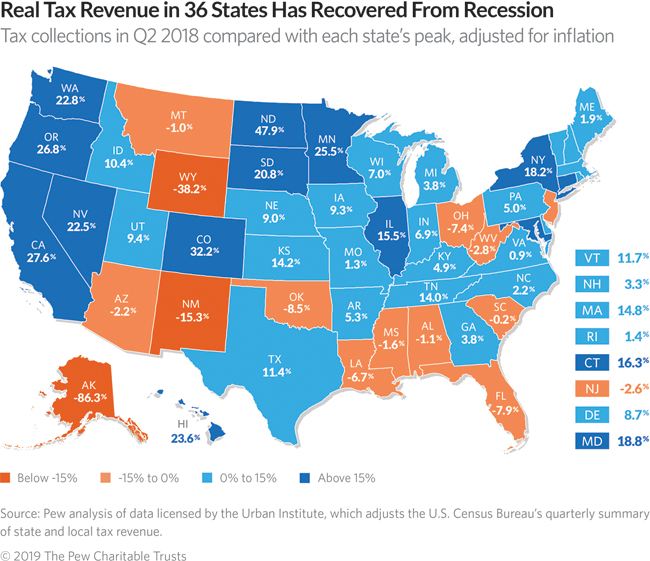

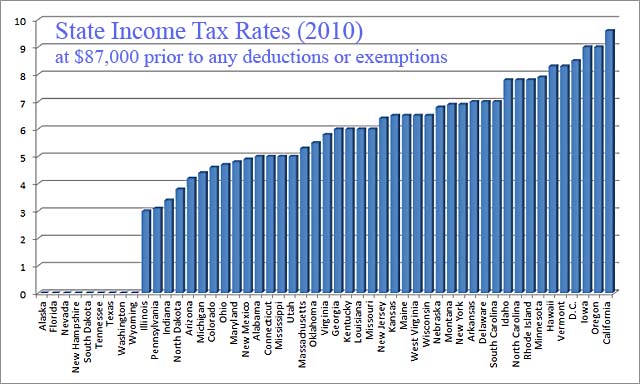

The charts below compare them by income tax sales tax and property tax.

State tax comparison. Taxpayers and legislators since 1941 serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates collections burdens and more. 211 rows State tax levels indicate both the tax burden and the services a state can afford to. Effective Total State Local Tax Rates on Median US.

So if you earn 50000 per year or 500000 per year the person earning 50000 will pay the same percentage of income tax as the person that earns 500000. Property values are the other crucial factor explaining differences in property tax rates. Tax per 1000.

There are eleven states in the US. In the remaining states total state and average local tax rates range from 534 to 955. Household Annual State.

California applies its highest tax rate to those who earn more than 1 million. Tax per 1000. Here is a list of states that impose a flat rate of income tax.

Start here to research states with the heaviest tax burdens. Taxes total local taxes are considerably higher in Birmingham 2899 vs. In our property taxes comparison by state New Jersey Connecticut and New Hampshire have the highest median property taxes paid.

California tops the list with the highest tax rates in the countryits highest tax rate is 1330 a full 23 more than Hawaii the runner-up for the highest tax rate with 1100. States with the highest sales tax rates are California Indiana Mississippi Rhode Island and Tennessee. That try to keep things simple when it comes to state income tax rates.

2020 Top Income Tax Rates By State. Gas taxes and fees. Hawaii has a general excise tax thats very similar to a sales tax though at 400 it would be one of the lowest sales taxes in the US.

Hover over any state for tax rates and click for more detailed information. 51 rows Based on this chart Oregon taxpayers pay 84 of their total income to state and local taxes. In this category the positions are reversed as New Hampshire has the highest percentage of 6366.

Cities with high property values can impose a lower tax rate and still raise at least as much property tax revenue as a city with low property values. Total taxes Tax per 1000. Forty-five states and the District of Columbia impose a state sales and use tax.

Alaska Delaware Montana New Hampshire and Oregon are free of sales tax but some Alaska cities charge local sales tax. Scroll down for a list of income tax rates by state. Compare relative tax rates across the US.

Sales and excise taxes. Compared by average income tax bracket. Arizonas top income tax rate of 454 doesnt kick in until taxable income exceeds 158996 for.

For visualizations and further analysis of this data explore our weekly state tax maps or join our weekly tax. Based on the lowest average or highest tax brackets. Average state and local sales tax.

So it makes sense that property tax represents a significant share of the general income of these states. Tennessee has the highest sales tax rates in the US.

State By State Guide To Taxes On Middle Class Families

State By State Guide To Taxes On Middle Class Families

State Corporate Income Tax Rates And Brackets For 2019

State Corporate Income Tax Rates And Brackets For 2019

A 50 State Comparison Of Income Taxes Sightline Institute

A 50 State Comparison Of Income Taxes Sightline Institute

Monday Maps State And Local Tax Burdens Vs State Tax Collections Tax Foundation

Monday Maps State And Local Tax Burdens Vs State Tax Collections Tax Foundation

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

State Tax Levels In The United States Wikipedia

State Tax Levels In The United States Wikipedia

How High Are Property Taxes In Your State Tax Foundation

How High Are Property Taxes In Your State Tax Foundation

Us Property Tax Comparison By State

Us Property Tax Comparison By State

2020 State Individual Income Tax Rates And Brackets Tax Foundation

2020 State Individual Income Tax Rates And Brackets Tax Foundation

State And Local Sales Tax Rates 2019 Tax Foundation

State And Local Sales Tax Rates 2019 Tax Foundation

State Tax Revenue Makes Biggest Gains In Seven Years The Pew Charitable Trusts

State Tax Revenue Makes Biggest Gains In Seven Years The Pew Charitable Trusts

Infographic 529 State Tax Deduction Value Comparison Map My Money Blog

Infographic 529 State Tax Deduction Value Comparison Map My Money Blog

- Get link

- X

- Other Apps

Comments

Post a Comment