Does Klarna Do Credit Check

- Get link

- X

- Other Apps

We make this clear to consumers who are considering using Klarna financing product in the. Does Klarna Financing affect your credit score.

Using Klarna might affect your credit score when.

Does klarna do credit check. Deciding to Pay in 4 interest-free installments. Choosing to Pay in 3 instalments Deciding to Pay in 30 days Taking out a Covid-19 related payment holiday. This will show up as a request on your credit report.

For installment and pay-later purchases Klarna runs a soft credit check which does not impact the consumers credit score or appear on their credit report. Klarna wont help customers with. Klarna uses Experian and TransUnion for their credit checking so if Klarna has searched you within the last two years it should appear on your reports with these agencies.

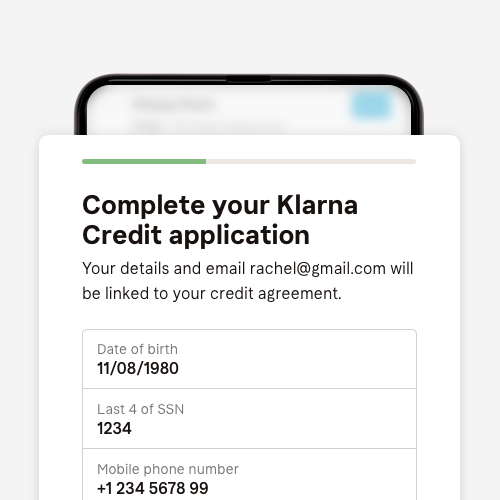

Purchasing with a One time card for the first time. Hard credit searches will appear on your report for both you and lenders or creditors to see and they can have a detrimental impact on your credit score. Use of our Financing product is dependent on a full credit check a customers previous credit history and other factors are reviewed.

Answered Mar 24 by Mohamed 105k points Related questions 1 answer. Signing up to use Klarna. For the above mentioned we will perform a credit check will not be visible to other lenders and therefore wont impact your credit score in any way.

Applying for one of our Financing options. This is usually only a temporary dip in your credit rating but too many hard searches or credit. In this instance there will be a record of the search on the customers credit file with the CRA.

We will not perform a credit check on you when. Preferring to Pay in 30 days. When making a new purchase if.

Enter your credit card or debit card details and that card will be charged in 30 days for the items you decide to keep. It runs a hard credit check for those. Klarna offers different ways to pay including a deadline of up to 30 days or making three equal monthly instalments.

We will perform a credit check when. Jul 28 2020 1200am Afterpay has hit back at rival Klarna after the Swedish firm part-owned by Commonwealth Bank said its constant checking of users credit files could. Downloading the Klarna App.

Credit check Klarna UK. Well the answer is yes but Klarna say the credit check they carry out when you apply for most of their products is whats known as a soft search. We dont think anyone should be financing things like clothes.

Because this option charges your credit card directly keep in mind. Due to this product being a regulated product where a formal credit agreement is taken out this will be visible on a customers credit file and may impact a customers credit score. Using Klarna will not affect your credit score when.

If you apply for Financing with Klarna a hard search will be made into your credit report. At check out from a partnered merchant. Applying for one of our Financing options.

It says that it does a soft credit check which doesnt affect credit scores. Similar to all traditional finance providers who offer products of this nature with the customers consent a hard credit check is undertaken. Pay later by card When you pay later by card you can add your items to your cart and check out with Klarna.

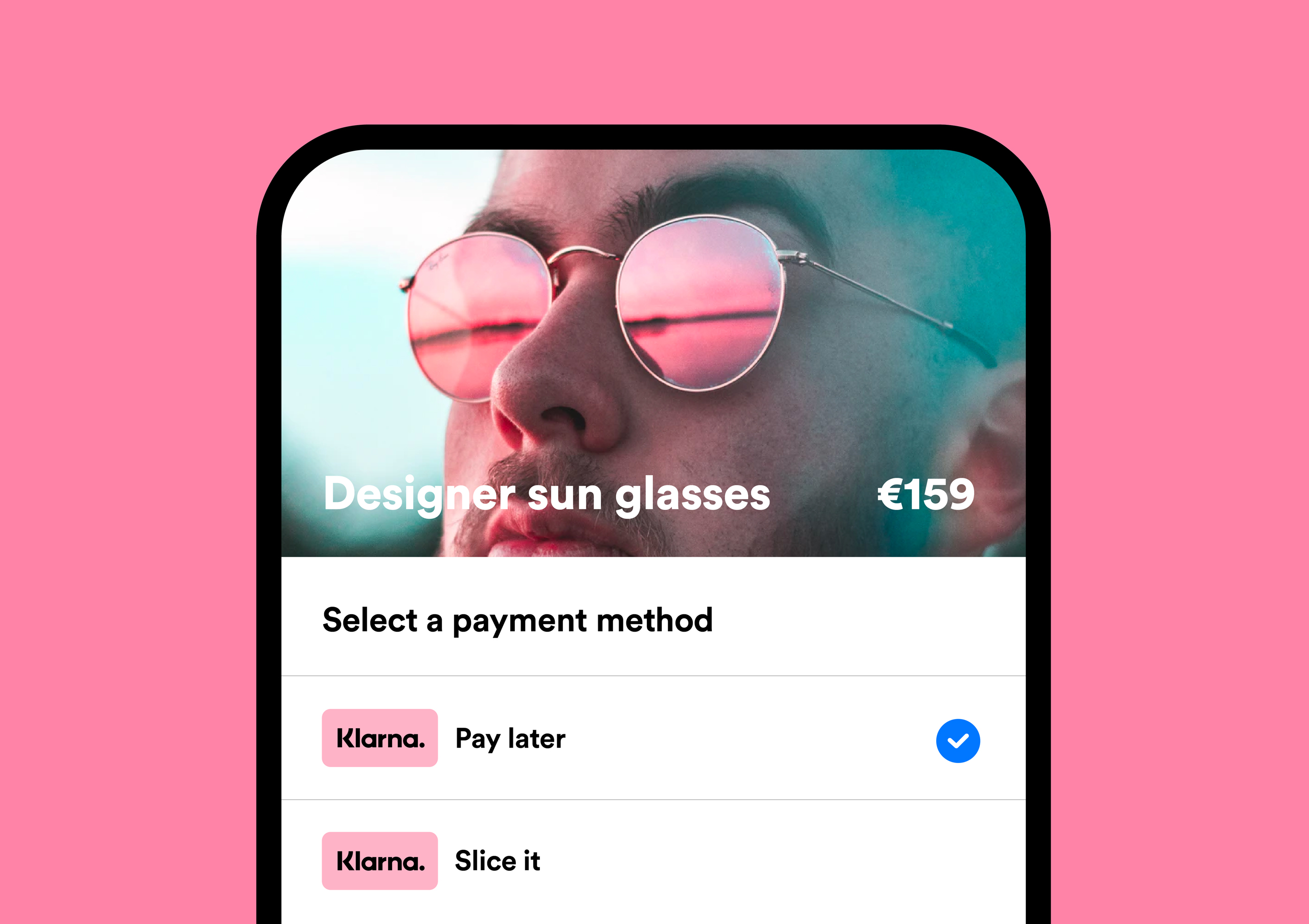

Similar to all traditional finance providers who offer products of this nature with the customers consent a hard credit check is undertaken. Financing formerly known as Slice it is Klarnas only regulated credit product with payment plans typically from 6-36 months. Signing up to use Klarna.

However most Klarna financing requires an application complete with a credit check which will result in a hard pull of your credit report. Does klarna affect credit score. Yes Klarna might do a check as part of their application measure.

You can see who has been performing searches on you by checking your Credit Report. We will perform a credit check when. Does Klarna impact my credit score.

We will not perform a credit check on you when. That means youll need to carefully consider how a financing plan will affect your score before choosing this option. Klarna might do a soft credit check when you use the Pay in 4 feature which doesnt appear on your credit report.

Klarna credit check UK So does Klarna do a credit check. Downloading the Klarna App. Asked Mar 10 by asklent032021 574k points 0.

This is Klarnas only regulated credit product with payment plans typically lasting 6-36 months. When you use Klarna to split your purchase into 4 interest-free payments we run a soft credit check. It wont affect your score.

This sort of check will not effect your financial assessment or show up as a hard request on your credit report. Klarna may issue a small verification charge of up to 1 that youll be credited back.

Klarna 22 Key Facts You Need To Know Endless Gain

Klarna 22 Key Facts You Need To Know Endless Gain

Does Klarna Impact My Credit Score Klarna Uk

Does Klarna Impact My Credit Score Klarna Uk

Klarna Spending Limit How To See Your Credit Limit Does Klarna Even Have It Youtube

Klarna Spending Limit How To See Your Credit Limit Does Klarna Even Have It Youtube

Klarna Review How It Works How To Get Approved Creditcards Com

Klarna Review How It Works How To Get Approved Creditcards Com

Accept Klarna Slice It Payments On Your Webshop Mollie

Accept Klarna Slice It Payments On Your Webshop Mollie

Klarna Review How It Works How To Get Approved Creditcards Com

Klarna Review How It Works How To Get Approved Creditcards Com

Merchant Assets Branding Visuals Official Klarna Technical Documentation

Merchant Assets Branding Visuals Official Klarna Technical Documentation

Does Klarna Impact My Credit Score Klarna Uk

Does Klarna Impact My Credit Score Klarna Uk

Klarna Review How It Works How To Get Approved Creditcards Com

Klarna Review How It Works How To Get Approved Creditcards Com

Testing Environment Official Klarna Technical Documentation

Testing Environment Official Klarna Technical Documentation

Buy Now Pay Later How It Works Klarna Us

Buy Now Pay Later How It Works Klarna Us

Comments

Post a Comment