State Wise Tax In Usa

- Get link

- X

- Other Apps

According to the Tax Foundation a nonpartisan tax research group in Washington DC these states and their top tax rates as of 2020 are. We pay taxes to the federal government.

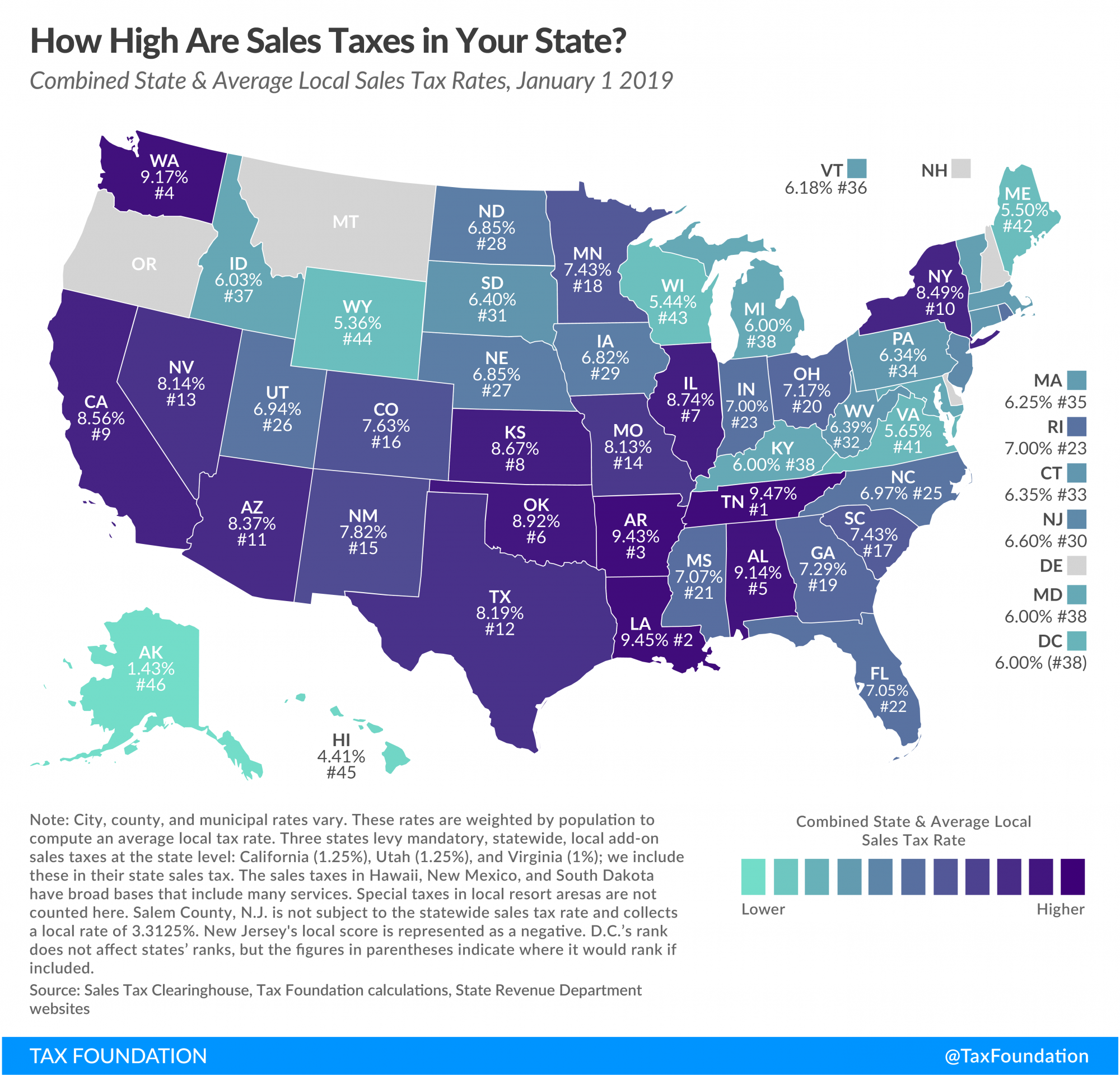

States With The Highest And Lowest Sales Taxes

States With The Highest And Lowest Sales Taxes

Tennessee and New Hampshire only apply state income tax to interest and dividend income.

State wise tax in usa. Using the United States Tax Calculator First enter your Gross Salary amount where shown. State income tax rates tend to be lower than federal tax rates. We pay property taxes sales taxes.

Six states have an inheritance tax. So if you earn 50000 per year or 500000 per year the person earning 50000 will pay the same percentage of income tax as. Few states impose an income tax at rates that exceed 10.

Federal Income Tax - Minimum Bracket 10 Maximum Bracket 396. We also pay local and state taxes. The amount of state and local income tax you pay will depend on how much income you earn and the tax rate of the state or locality where you live.

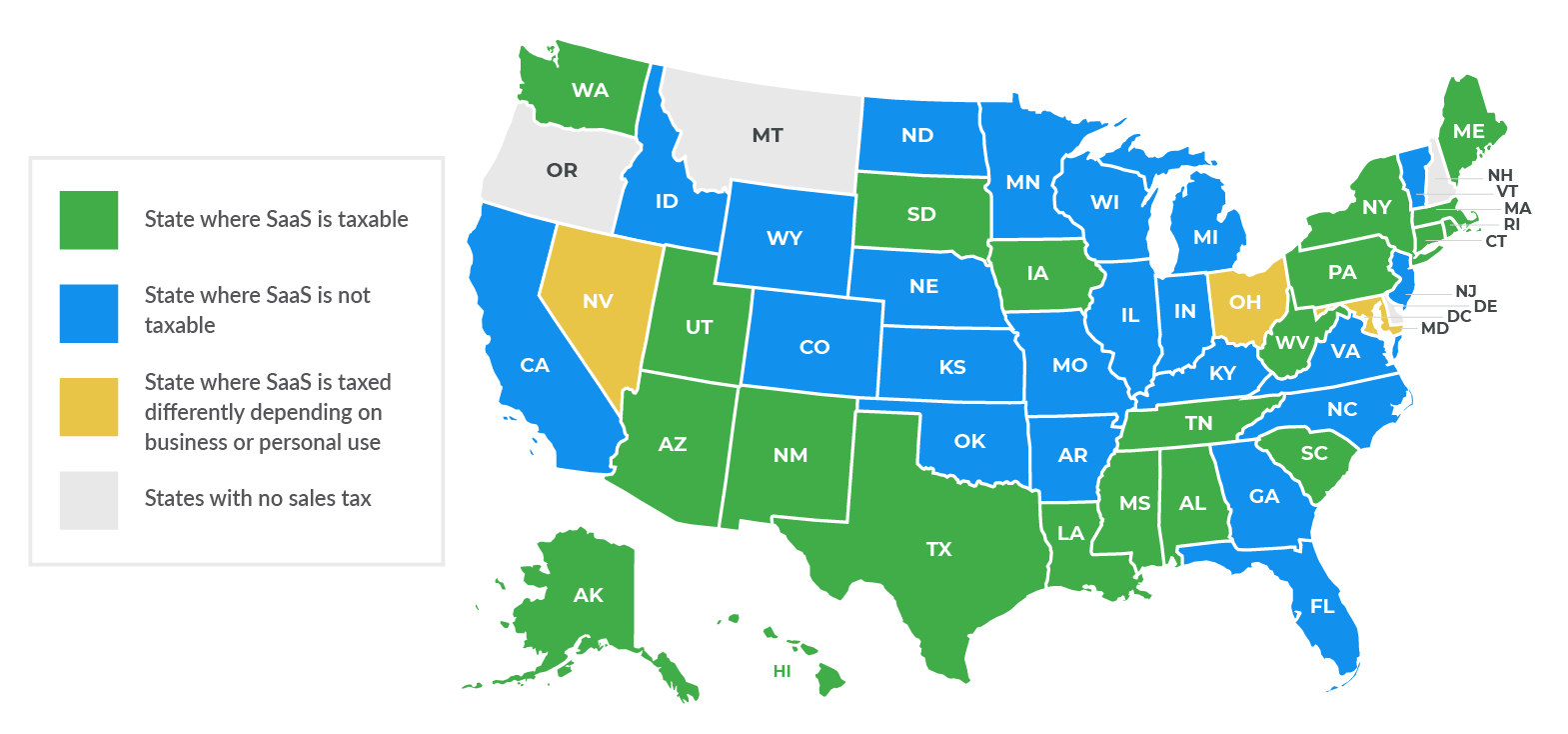

The tax applies not to the estate itself but to the recipients of the property from that estate. The United States US does not have a national sales-tax system. Most state governments in the United States collect a state income tax on all income earned within the state which is different from and must be filed separately from the federal income tax.

Next select the State drop down menu and choose whichever state you live in. Georgia is ranked 33rd in the country for property taxes. Some are levied directly from residents and others are levied indirectly.

Tax varies by state but the average sales tax is around 725. Alaska Wyoming and South Dakota are the three states where taxes are lowest according to a new analysis of tax rates that form the basis of a Yahoo. Some states tax as little as 0 on the first few thousand dollars of income.

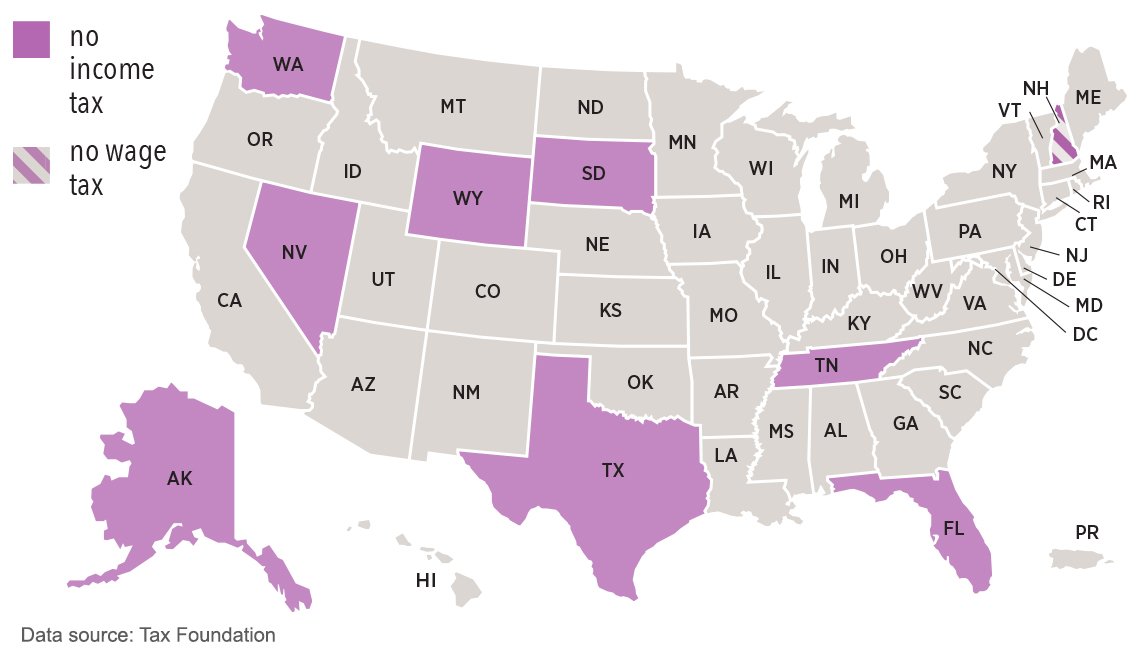

For example the direct state tax. However states like Texas Florida Nevada Washington Wyoming South Dakota and Alaska have no state income tax. To find out how much you owe and how to pay it find personal income tax information by state.

Adult citizens in the United States pay a variety of different taxes. This table includes the per capita tax collected at the state level. Rather indirect taxes are imposed on a sub-national level.

Types of indirect taxes VATGST and other indirect taxes. If you are filing taxes and are. On up to 2400 for married couples filing separately and individual filers 825 on taxable income.

Find State and Local Personal Income Tax Resources. That try to keep things simple when it comes to state income tax rates. In many states local jurisdictions eg.

Of course each state will collect taxes from you in one way or another. It isnt just your annual state tax return either. Most of the 50 states impose some personal income tax with the exception of Alaska Florida Nevada South Dakota Texas Washington and Wyoming which have no state income tax.

Of these one state Maryland also has an estate tax. Overall state tax rates range from 0 to more than 13 as of 2021. Among the states that tax income Pennsylvanias 307 flat tax ranks the Keystone State as the 10th lowest in the nation for 2020.

There are eleven states in the US. State income tax. Some states also may eliminate certain taxes but often theyre merely paying more in other types of taxes.

For example if you receive 1000 as an inheritance and are subject to a 10 inheritance tax you would pay 100 back in taxes. 133 on incomes over 1 million 1181484 for married filers of joint returns but Social Security benefits arent taxed here. 211 rows State tax levels indicate both the tax burden and the services a state can afford to provide residents.

Applicable in addition to all state taxes. Your state taxpayer advocate can offer protection during the assessment and collection of taxes. This table does not necessarily reflect the actual tax burdens borne directly by individual persons or businesses in a state.

Many range between 1 and 10. California Hawaii Oregon Minnesota New York and New Jersey have some of the highest state income tax rates in the country and eight states have no tax on earned income at all. As well most states also have an additional state income tax.

States Income Tax Rates that apply a flat rate. Next select the Filing Status drop down menu and choose which option applies to you. New Hampshire and Tennessee until 1 January 2021 tax only dividend and interest income.

Homeowners pay an average 083 percent and the yearly tax. Each state has the authority to impose its own sales and use tax subject to US constitutional restrictions. 14 on taxable income up to 4800 for married couples filing jointly.

State income taxes are low ranging from 1 percent to 6 percent and the average state and local sales tax rate is 701 percent. In addition Tennessee and New Hampshire limit their tax to interest and dividend income not income from wages. States use a different combination of sales income excise taxes and user fees.

State And Local Sales Tax Rates 2019 Tax Foundation

State And Local Sales Tax Rates 2019 Tax Foundation

State Corporate Income Tax Rates And Brackets For 2020

State Corporate Income Tax Rates And Brackets For 2020

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

State By State Guide To Taxes On Middle Class Families

State By State Guide To Taxes On Middle Class Families

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

9 States That Don T Have An Income Tax

9 States That Don T Have An Income Tax

State Wise Tax Payers In The Usa Waterpedia

State Wise Tax Payers In The Usa Waterpedia

How Much Does Your State Rely On Sales Taxes Tax Foundation

How Much Does Your State Rely On Sales Taxes Tax Foundation

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

2020 State Individual Income Tax Rates And Brackets Tax Foundation

2020 State Individual Income Tax Rates And Brackets Tax Foundation

Sales Tax By State Is Saas Taxable Taxjar Blog

Sales Tax By State Is Saas Taxable Taxjar Blog

Comments

Post a Comment